UBER AND LYFT COMMERCIAL INSURANCE

Uber commercial insurance is offered by Progressive Commercial Insurance. The same company that offers regular auto insurance.

Lyft commercial insurance is offered by State Farm Commercial Insurance. The same company that offers regular auto insurance.

DOES PROGRESSIVE AND STATE FARM INSURANCE KNOW IF I DO RIDESHARE?

The short answer is, YES, they do. Being the same company that offers commercial insurance to Rideshare companies, they know that you have a commercial policy to work at Uber and Lyft. In fact, any insurance company has this information at its fingertips due to the records shared by some information bureaus such as Lexis Nexis.

WHY CAN MY COMPANY KNOW AND NOT TELL ME ANYTHING ABOUT IT?

When we perform Rideshare services and do not report it to our insurance company, we run different risks which I will mention below.

- If an accident ever occurs whether you are doing at that moment Rideshare or not, your car insurance company may refuse to cover your car damage and medical expenses simply because you have commercial insurance that proves that you do Rideshare. You can spend months, years paying regular car insurance but once an incident occurs you have simply paid car insurance for a long time in vain.

- You can be expelled from your insurance policy without even having an accident for not having reported that you do Rideshare. This will force you to look for another policy which may cost you more.

- They can increase your insurance policy at an unpayable price for not having reported to your insurance that you do Rideshare.

WHAT IS THE DEDUCTIBLE AND OUR COVERAGE WITH UBER AND LYFT?

The insurance deductible they offer is $2,500 USD. How does this deductible work? Below I will explain what the coverage phases are, what coverage we have and the disadvantages.

It is important to understand something. These coverages are only for Uber and Lyft. InDrive has not released any information related to the type of coverage it offers drivers to date.

The coverage phases in Uber and Lyft are as follows

Phase 0: The Driver is disconnected from the application.

Phase 1: The driver is logged into the app, but has not yet accepted a ride.

Phase 2: The driver has accepted a ride and is on his way to pick up the passenger.

Phase 3: The passenger is in the vehicle and the trip continues until they are dropped off.

After this, the driver goes to Phase 1 if he continues working.

The coverages are as follows

Phase 1 Coverage when you are online and available for a trip $50,000 per person and $100,000 per accident for injuries $25,000 in property damage per accident

Phase 2 Coverage when you are en route to pick up a passenger or on a trip Insurance that covers at least $1,000,000 for property damage and injuries to passengers and third parties involved in an accident in which you are at fault. Insurance that covers the cost of repairing your car, up to its current cash value, with a $2,500 deductible, depending on your personal insurance, which includes comprehensive and collision coverage. This additional insurance maintained by Uber protects your car, no matter who is at fault. If you maintain comprehensive and collision coverage on your own vehicle.

In all phases 1, 2 and 3, any damage that occurs to our car...

Being guilty

A hit-and-run accident

If the person who impacts you does not have insurance

If someone hits you and at the same time push your car, and you end up hitting another car

...you have 2 options.

Make the claim to Uber or Lyft. Whether you are guilty or not. You must pay the first $2,500 USD of the cost of the damages out of pocket.

Make your insurance claim. You may have a lower deductible, but you risk losing your coverage and benefits if you don't tell your company that you work for Uber or Lyft.

What is most striking in all this? That in any scenario that we are going to claim from Uber or Lyft, we must pay a deductible of $2,500 USD. These companies do not pay enough to save and have $2,500 USD saved for an event of this type.

Another important fact to understand in coverage. If a customer damages your property (your car) whether by breaking a window, glass, door, scratches, damage to the seats, whatever and you report it to Uber or Lyft. They will open a claim, and you will have to cover the cost of the first $2,500 USD of damage. It means that any damage less than $2,500 USD is the driver's responsibility.

HOW MUCH DO WE PAY FOR COMMERCIAL INSURANCE?

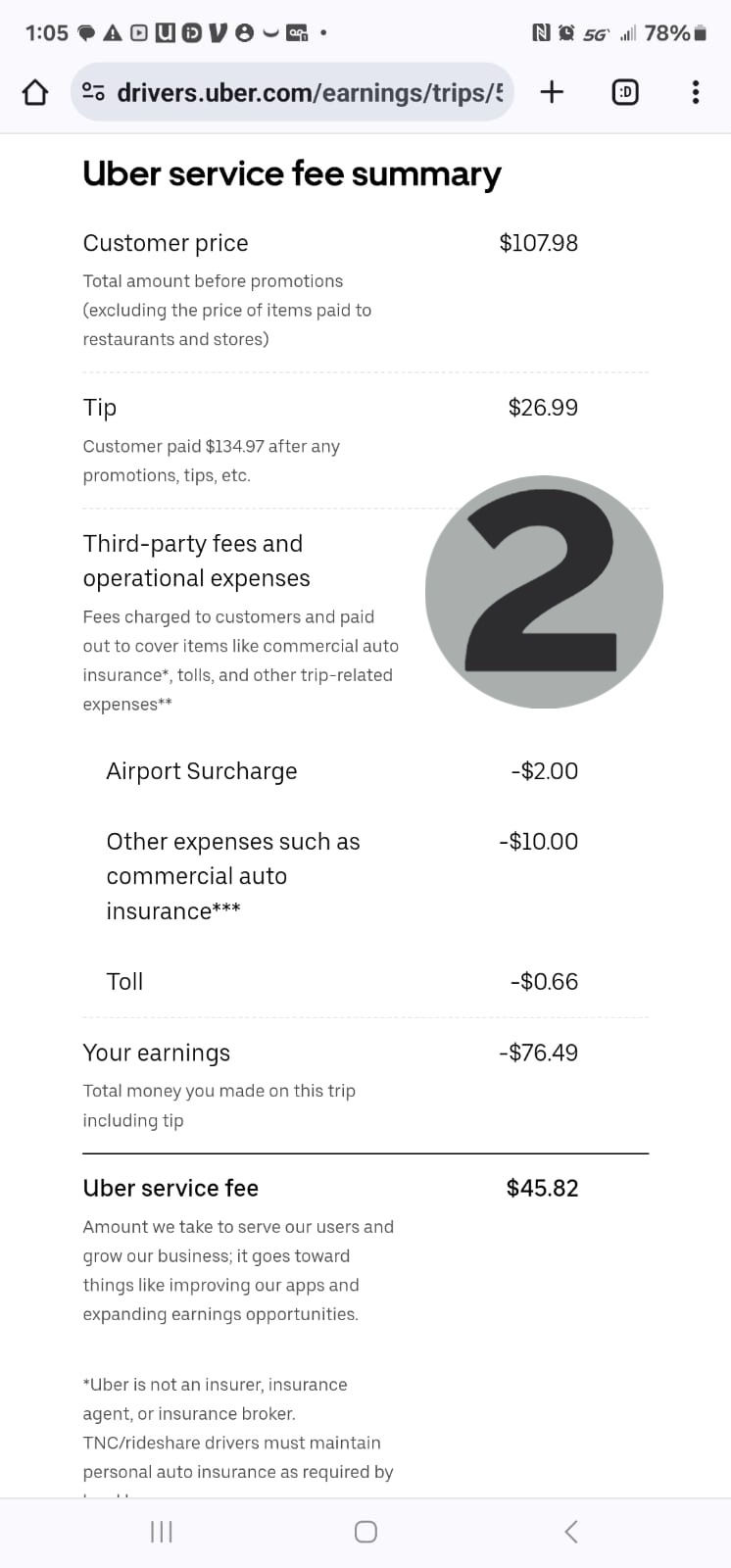

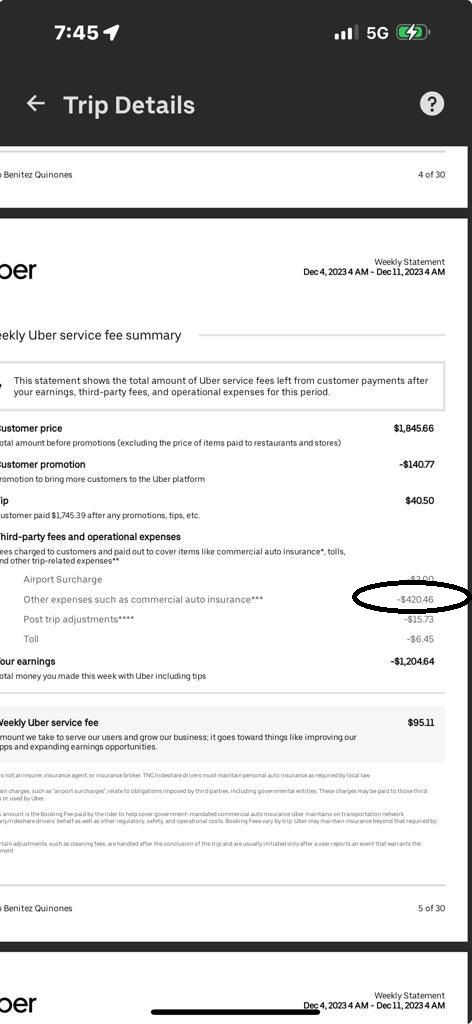

Many drivers have no idea that we currently pay commercial insurance, and it is quite high. Every $1 that Uber and Lyft charge us for commercial insurance is money that we stop receiving, so many drivers who drive 40, 60, 80 hours a week stop receiving $400 or more a week to cover the cost of that insurance. In the following images, you can see it.

2 weeks ago, the commercial insurance we paid for at Uber had a limit of $10 USD. Uber charged a maximum of $10 USD for trips. This amount was raised to $50. Now they almost always charge $10 USD and up.

As you can see in image #2 the maximum was $10 USD. Now it's $50.

Do you want to know how much you pay in commercial insurance? Well, you can find out by going to the following link https://drivers.uber.com/earnings/statements, this cannot be seen in the mobile application.

Now we will show you what the weekly payments for this insurance and the amounts look like. The more you work, the more trips you make, the more you pay in commercial insurance.

So we end up paying

Uber Commercial Insurance

Lyft Commercial Insurance

Auto Insurance

Rideshare Endorsement

The solution may be for each driver to take responsibility for their commercial insurance where instead of paying $1600 a month we could be paying $400 or $500.

QUESTIONS ABOUT COMMERCIAL INSURANCE

Many people don't know what they're talking about. When it is mentioned taking out our own commercial insurance it does not mean that we must have 2 insurances. Commercial insurance works for Commercial Insurance and personal Auto Insurance. There is no need to take out 2 policies (which is something that does not yet exist, no insurance company currently sells commercial insurance for Rideshare). The idea is to generate changes that pressure insurance companies to adapt to market conditions.

WHY DO UBER AND LYFT CHARGE SO MUCH FOR COMMERCIAL INSURANCE?

I beleive Uber and Lyft are currently reselling the insurance to drivers. What does this mean? Policy sale. Let's say they have a monthly insurance expense in Florida of $25,000,000 per month, they must collect that money by charging the drivers for the insurance. What happens is that they raise more than the necessary amount monthly which creates a backup fund for the company. This in one way or another represents positive numbers for the company. It generates income from profits and generates income through other means.

I hope this information helps you understand a little better the work done by some who drive for up to 12 hours or more every day. Remember that this type of work requires a very high investment of resources and the objective of each of you is to obtain remuneration according to the investment of resources you make. This is not an hourly job. It is a business where you put your resources and charge according to the risks you incur and the total value of what you invest. At least for me, my time is priceless or quite high. That is one of our most valuable resources.

Comments